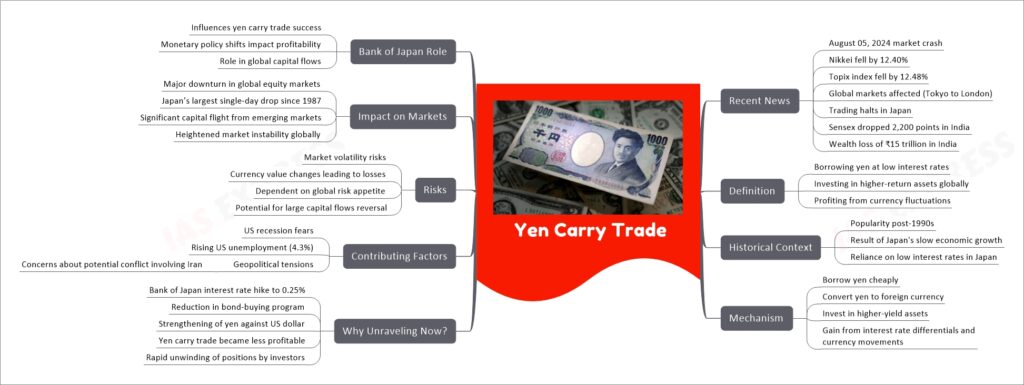

Yen Carry Trade

Summary: The yen carry trade is a financial strategy where investors borrow Japanese yen at low interest rates and invest in higher-yield assets in other countries. The trade relies on stable interest rate differentials and favorable currency fluctuations. On August 05, 2024, a significant market downturn occurred, largely due to the unwinding of the yen carry trade following the Bank of Japan’s decision to raise interest rates and reduce its bond-buying program. This shift made the yen carry trade less profitable, leading to a rapid sell-off and severe declines in global markets. Additional factors, including fears of a US recession and geopolitical tensions, exacerbated the market instability.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.